Frequently Asked Questions

You can register as an FPX merchant as your preferred FPX participating bank or third-party acquirer. The respective bank will make the necessary arrangements for you.

FPX services can run on any platform.

You will be provided with a “seller plug-in” i.e. security software that must be installed at your web server.

FPX allows you to reach to a wider customer base including non-credit cardholders. In addition, you will enjoy real-time online payment and confirmation upon successful transactions. This will reduce your reconciliation requirements. In addition, you need not maintain accounts with multiple banks.

For individual banking account, maximum amount is limited to RM 30,000.00 per transaction

For corporate banking account, maximum amount is limited to RM 1,000,000.00 per transaction.

However, the above limit is subject to the customer’s Internet banking transaction limit, whichever is lower.

For further inquiry and clarifications on FPX payment, please contact your preferred FPX participating Banks.

FPX uses highly standards of authentication and certification to ensure all transactions are secure.

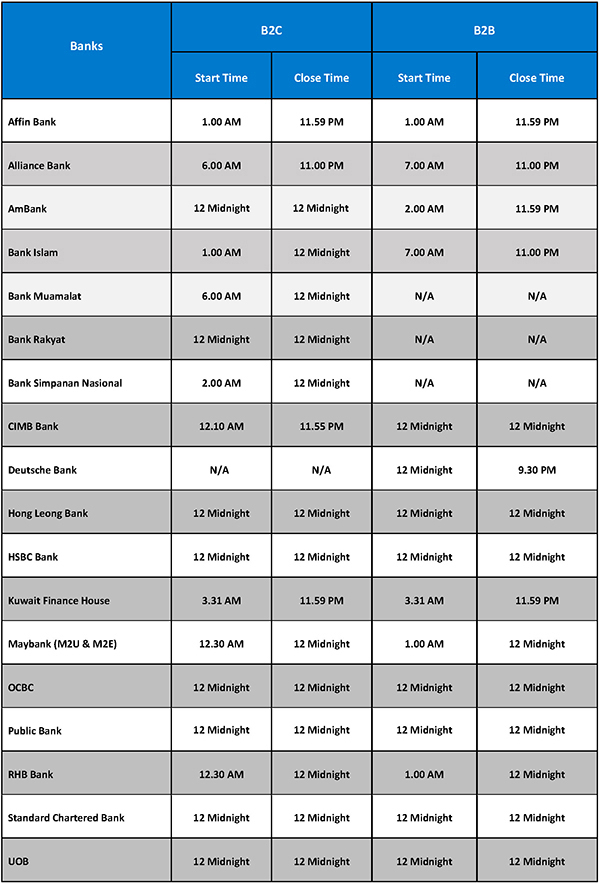

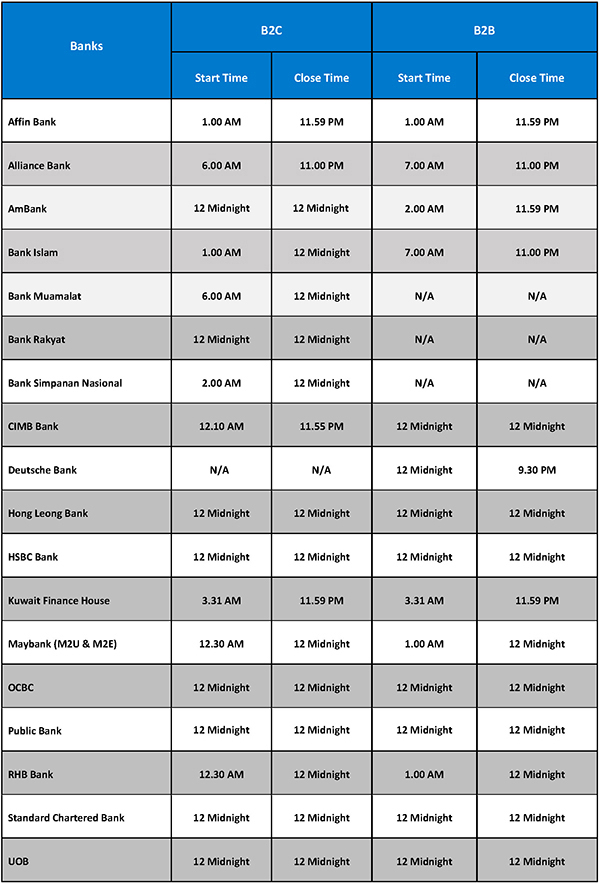

Currently FPX service is available from 1:00 AM to 12:00 midnight daily* by most of the FPX participating banks.

*Depending on the participating banks’ internet banking service availability.

*Depending on the participating banks’ internet banking service availability.

No. FPX service can support both payments by individual and corporation depending on the model subscribed by your merchant. Payment made by individual is known as Business to Consumer (B2C) model, while payment made by corporation is known as Business to Business (B2B) model.

© 2023-2025 Payments Network Malaysia Sdn Bhd (PayNet) 200801035403 (836743-D). All Rights Reserved. Legal